This month marks the 10th anniversary of the founding of Juniper Square.

While our employees know our founding story (now public here), for our 10th anniversary, I wanted to publicly share what I think we got right, where we missed, and what we hope to accomplish in our second decade.

After ten years of working together, I’m so grateful that all three co-founders, Adam Ginsburg, Yonas Fisseha, and myself are still at the company, are still on the board together, and our relationship is as strong as ever. While the road has been longer and harder than we imagined, our success has also wildly exceeded our expectations. As we transition from one decade to the next, the opportunity for private markets transformation is much bigger, broader, and deeper than we could have foreseen or hoped for ten years ago.

Zigging when everyone was zagging

We started Juniper Square with an ambitious goal: to digitize the world’s private equity partnerships, with an ultimate vision of making the private markets more efficient, transparent, and broadly accessible.

At the time, with the passing of the JOBS Act in 2012, crowdfunding was being heralded as the key to digitizing and democratizing the private markets. It was particularly trendy in real estate, with dozens of startups formed to chase the opportunity.

We worried about the adverse selection effects inherent in private equity. Just like it’s hard to get a reservation at a good restaurant, it’s hard to get into a good manager’s fund, and therefore, we viewed it as unlikely that most good managers would be willing to post their investments and track records on public websites. As a result, we believed that crowdfunding wasn’t going to work beyond a niche audience of enthusiast investors and emerging managers who together constituted a small addressable market.

That still left the question of how to achieve our goal. Before anything truly transformative could be done in terms of capital markets transformation, we reasoned that a substantial portion of the market’s private equity funds would need to be brought into some kind of central system of record, sector by sector (meaning CRE, VC, PE, hedge funds, etc.), with both the issuers and the investors connected around the same record of ownership.

We saw investor relations as the optimal path to that outcome since ,at its core, it’s about the movement of money and information between GPs (issuers) and LPs (investors) in a complex, mission-critical, regulated environment. In other words, it is a lot like how the public markets work.

Investor relations also has the benefit of being a purchase decision that’s controlled by the GP, who has budget to spend on technology, and not the LP, who by and large doesn’t (at any kind of interesting scale anyway; pension funds don’t exactly have technology budgets that excite the entrepreneur).

It seemed clear to us that once we were viewed by GPs as a trusted hand with their complex financial matters, and if we designed our products with scale and the end goal in mind (i.e, the data model for our investor relations software was the same that would support future capital markets offerings), we would not only be able to leap through creating unique solutions to all of GPs’ financial needs in an advantaged way, but also create truly transformative marketplace offerings and reshape how the capital markets functioned.

We’ve now proven that we can do this by bridging from investor relations, where we have 2,000 GPs as clients, to fund administration, where we have ~250 clients, a disruptive and innovative offering, and are rapidly expanding into a market 20x the size.

Not many viewed our strategy favorably, however. Few at the time could see that you could grow from selling investor relations software to GPs in a single sector to this kind of broad vision.

Nevertheless, that’s exactly what we set out to do with Juniper Square. But we needed to convince everyone else of that, too, which proved to be a daunting task.

The initial pitch process

Despite having a live product with 20+ customers, $250K in annual recurring revenue, and three repeat co-founders, no one wanted to invest in us. Our initial market seemed ridiculously small, and few believed in our long-term vision. There were no comparables we could point to, so we couldn’t provide the shorthand that we’d be “Like Uber, but for X”.

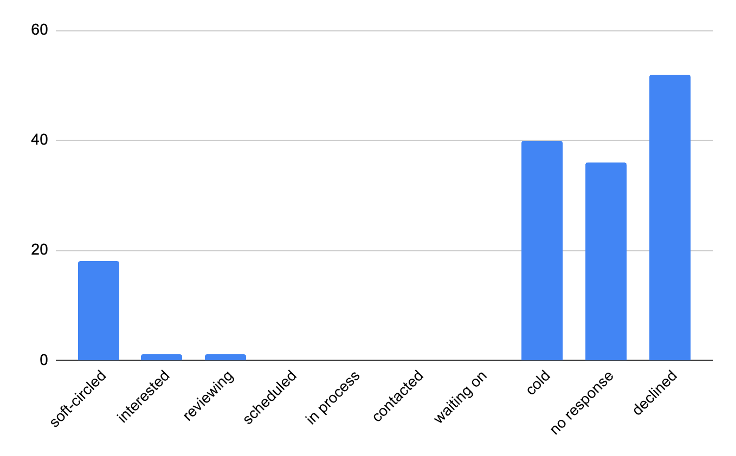

When I was trying to raise our seed round in 2015, I went up and down Sand Hill Road (VCs still took meetings there back then) and across SOMA in San Francisco, gathering 125 formal “No’s” from professional angel and seed investors and early-stage VCs. Everyone said the same thing: “Great team, impressive early traction, stupidly small market. Pass.”

To raise our $2MM seed round, I had to meet with more than 200 investors over 6+ months. Those efforts landed us checks from 21 different investors, some as small as $25K. If we thought it was going to take a lot of grit to achieve our vision, this was a good first lesson.

At the end of our seed fundraising process, our funnel looked like this:

It was only because Kevin Laws, then the COO of AngelList and a personal friend of my co-founder, Adam, stepped up to lead the round with the backing of several funds on AngelList, that we were able to get it done. Thanks to his leadership and the faith of our early GP customers, alongside a few brave souls like Eric Chen of OVO Fund, Charles Hudson of Precursor VC, and Dave Eisenberg of Zigg, we were able to raise our seed round and continue the pursuit of our mission.

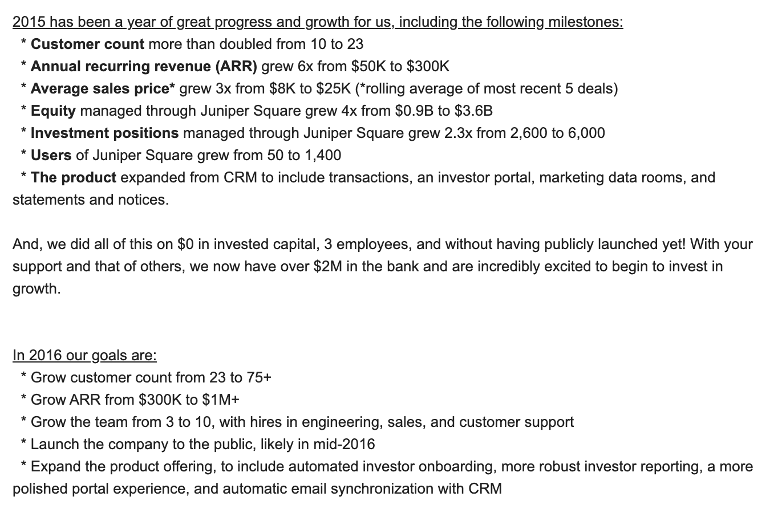

At the end of 2015, having just closed our seed round, I wrote to those first investors:

We owe a huge debt of gratitude to Kevin and the early-stage investors who were crazy enough to believe in us, as well as to Sundeep Peechu of Felicis, Nick Shalek of Ribbit, Elliot Geidt of Redpoint, and Darragh O’Flaherty of Blue Owl who have all had the courage of their convictions and backed us at each subsequent stage of the journey.

Anyone who is interested can check out our seed-stage fundraising deck here. We are still pursuing the same strategy—investor relations SaaS to fund administration to capital markets transformation—that we outlined back in 2015.

Where we find ourselves today

Ten years in, I think it’s safe to say we have achieved the initial scale goal we set out to accomplish. Today, we serve 2,000 GPs who are managing 35,000 funds and SPVs via our platform. Each year, more than 1M K-1s go out to LPs via Juniper Square, and more than 500,000 unique LPs sign into our portal to manage their direct PE investments. $250B has gone out to investors via distributions, and more than $1T in active investor equity is managed via our platform. That’s nearly 9% of the entire private equity ecosystem of $11.7T. That may not seem like a huge share, but in a $12T market, if you have $1T structured and organized and networked, and the rest is on spreadsheets, that’s meaningful.

While we definitely have achieved real scale, it’s funny to think that from our perspective as co-founders, we’re so far behind where we expected to be in the success case (i.e., we figured 90% chance the effort would fail, but in the 10% chance of success, that we’d be a $100B public company by now - ha!).

Where we missed

Despite some of our successes, it hasn’t all been sunshine and apple pie; we’ve had our fair share of misses, too.

Like many growth-stage companies, as the Fed’s “zero interest rate policy” (or ZIRP) macrocycle came to a close, we had to trim our sails and refocus our efforts on our core businesses—investor relations software and fund administration services. This meant that many of the early pioneering areas we were investing in, from CRE portfolio data collection and monitoring tools for LPs, to private placement services for GPs, had to be rationalized and cut.

As Marc Andreessen has said, there are no bad innovations, only good ones that come too early. We still believe many of these areas will be worthwhile investments, but we now understand that we have to earn the right to invest in them by first building up excess profits in our core businesses.

We also over-hired during the COVID era. Much of that hiring was justified (our company is significantly bigger in terms of revenue, customers, etc., than it was prior to the pandemic), but we could have been more judicious about pumping the brakes on headcount growth during the Covid heyday for tech.

Lastly, while we recognized that retail investors would be huge growth drivers for the private equity industry over the next few decades, I don’t think we understood the outsized role that wealth advisors would play in directing those investments. Nor did we foresee that the rise of new products designed for this channel in the form of registered, evergreen, open-end funds (e.g., the BREIT) would favor only the biggest GPs—Blackstone, Apollo, KKR, etc.—who have powerful brands, giant distribution arms, and global reach across many different investing platforms.

I would say we were and still are more bearish than the average PE market participant on the true size of the pie when it comes to the retail investor. While everyone loves to tote huge numbers in the tens of, trillions in terms of the aggregate wealth of the retail investor, when you break it down per household basis and you consider the role that privates should play in a portfolio of, say, $1,000,000 of investable assets where liquidity is at a real premium, it’s not actually as much as it seems when you sum up the household allocations. But that’s a topic for another post.

Surviving the current market tumult

It’s safe to say that private equity broadly, and within it venture and real estate in particular, are going through a very challenging moment right now. LPs have turned off the spigot of new capital allocation as they wait for the denominator effect to normalize (this task is now largely done thanks to the public markets rally), the bid-ask spreads to narrow in certain markets like growth stage tech and office real estate, and capital already deployed to managers to be recycled. This means managers are in turn slowing down their pacing of capital deployment, lengthening fund lives, and biding time hoping that Fed rate cuts save us all (what people in the real estate industry call “extend and pretend” or “survive ‘til ‘25”).

Yet despite this once-in-a-generation slowdown in PE, the market remains very healthy. Privates are here to stay as a mainstay in the modern investor’s portfolio, and private equity is now being referred to as a globally systemically important industry, as evidenced by the SEC’s new Private Fund Adviser rules. Our GP customers are holding up quite well, given the market tumult, and as a result, we are still growing very aggressively through the market downturn.

Where we go from here

Ten years of building products for GPs has allowed us to impact the private markets at a significant scale. We have a seasoned team, market-leading offerings in investor relations and fund administration, and an enviable market position. So, where do we go from here?

In our investor relations business, we still have much to do. Our largest clients have asked for better connectivity to horizontal platforms such as Salesforce and a wide range of back- and middle-office data integrations. Across our client base, we also see the need for more automation and full-solution offerings around investor verification, compliance, and payments at a global scale.

The best way to understand where we are going with our investor relations offering is to think of it as a pixel-perfect overlay or interchange between the back office financial systems of thousands of GPs, hundreds of their administrators, auditors, and tax providers, dozens of financial intermediaries like DTCC, custodian banks, and the like, and hundreds of thousands of their LPs. Today, this data exchange process is intermediated by millions of PDFs, Excel spreadsheets, and labor from tens of thousands of individuals. Tomorrow, it will be direct, real-time, structured data feeds, just like in the public markets.

Within our fund administration business, we are a tech company that understands how deeply important the quality of our people are to the quality of service we can deliver to our clients. By building novel accounting technologies for our team of hundreds of fund accountants, we believe we will be able to attract and retain the best talent and our goal is to be the best place to work in fund administration and private equity. This in turn will enable us to further differentiate our already marketing-leading quality of service to clients.

In addition to innovation focused on our own team, over the next few years, you’ll see us innovate in three additional areas:

- First will be moving the workflows, communications, and data exchanges between GPs and their administrator into our app in a simple, secure, and structured way that provides for better QA and visibility, and a more streamlined, delightful experience for the GP. Think of the ability to request and track a complex capital call with the click of a button or the ability to review, annotate, and collaborate around financial statements in our software.

- Second is providing direct, near real-time access for our clients to all of the data we are collecting and managing on their behalf as their fund administrator. From the fund’s GL to the asset data we collect to do our work, all of the data we maintain for the GP will be made available to them in unique and inventive ways, which can be leveraged both for internal insights and external reporting.

- Third, we will continue to invest in our market-leading portal, such that GPs who administer their funds with Juniper Square will be able to provide hands-down the best LP experience anywhere in private markets. From reusable, pre-verified investor profiles that allow for 1-click subscriptions across any GP from any domicile to integrated, global compliance offerings around KYC, AML, FATCA, and CRS, to sophisticated, secure payments rails, to detailed fund, asset, and portfolio-level reporting coming directly from the GPs’ data sources, LPs will have an experience like no other on Juniper Square.

Along the way, there are adjacencies that we will build into that we believe will be big businesses in their own right. For example, as the data in our system grows richer, and as new technologies like AI advance in terms of data extraction and summation accuracies, so does the opportunity to offer data and benchmarking services for our GPs and their investors that are unlike anything available in private markets today.

And of course there is the massive opportunity to execute on the third leg of the business plan we laid out 10 years ago—capital markets. There is simply so much we can do to make the market more efficient.

The future of private equity

Over the next decade, we believe that the private equity industry will likely consolidate into two camps. On one end, GPs like Blackstone and Apollo will offer giant investing supermarkets, providing the full spectrum of private investment strategies to retail investors through evergreen, registered offerings that can easily be distributed through traditional wealth channels. While these will technically be “private equity” products, the open-end nature will restrict the investing strategies and risk/return requirements will differ from traditional PE style investing.

In the other camp will be a group of sharpshooter GPs that offer more illiquid, higher risk/return, traditional private equity products in closed-end structures that may not be appropriate for the mass-retail investor, but are well suited for truly high-net-worth individuals, and where the capital certainty of a closed-end product is required to pursue the investing strategy.

And for the 10K+ GPs who aren’t yet at Blackstone’s or Apollo’s scale but deliver great risk-adjusted returns, we believe we will be able to help them find their next generation of LPs, offer new products that have features like liquidity built-in, and in the process dramatically broaden access for investors, opening up private equity to an entirely new class of HNW investor.

Those are the types of private equity products that I prefer to invest in as an LP, and that’s where we aim to focus our marketplace efforts, knowing we can build upon the success of our first decade and substantially affect how these firms operate and administer their funds.

As we innovate in capital markets, our GP clients will remain our north star, helping to guide our innovation and, ultimately, the transformation of the private markets.

I could not be more excited for the decade of innovation that lies ahead.