Blog

Private markets insights for modern fund managers

Providing industry insights, content guides, and other esources to support our customers and their investors through every stage of partnership.

Trailblazing a new path for private credit operations

Christine Egbert sat down with Tony Chung & Jesus Mirabal to discuss how Juniper Square’s acquisition of Tenor Digital will transform private credit operations.

The State of VC: Q3 2025 shows life is better when you’re large

Exit activity rebounds to multi-year highs, but VC's bifurcated landscape favors the large and established.

The State of Private Equity Q3 2025: the long-awaited recovery knocks?

Lower borrowing costs are unlocking opportunities—but not everywhere. Find out which areas are thriving, which are struggling, and what comes next.

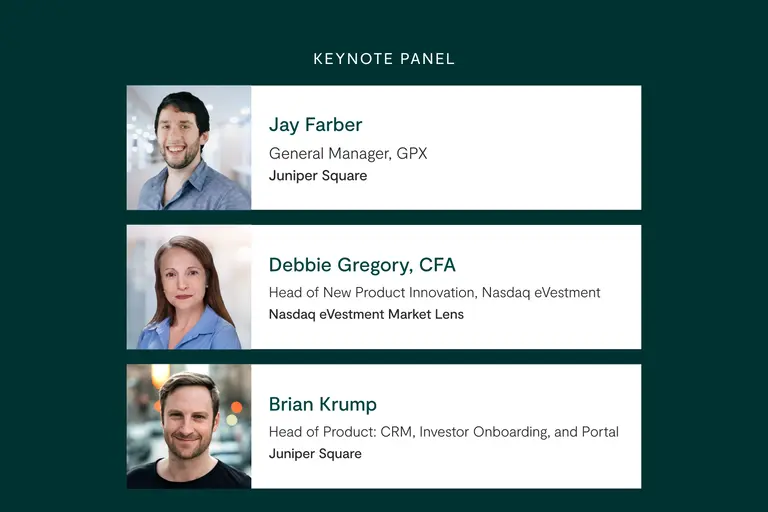

How AI is changing the investor relations function

Legacy CRMs can't meet the demands of modern investor relations. See what the future of fundraising looks like at our Nov 4th keynote with a live demo of our new AI CRM for Investor Relations.

Why GPs need an AI CRM for investor relations

Many GPs attempt to retrofit generic CRMs for fundraising use, but the hidden costs add up quickly.

How AI is transforming private markets

Alex Robinson, CEO and co-founder of Juniper Square, does a deep dive into the evolving role of artificial intelligence within private markets.

How LPs and GPs build trust in a changing market

Katie Riester, Managing Director at Felicis Ventures, reflects on her path from early experiences at Vanguard and Cambridge Associates to her current role helping shape one of the industry’s most adaptable early-stage firms.

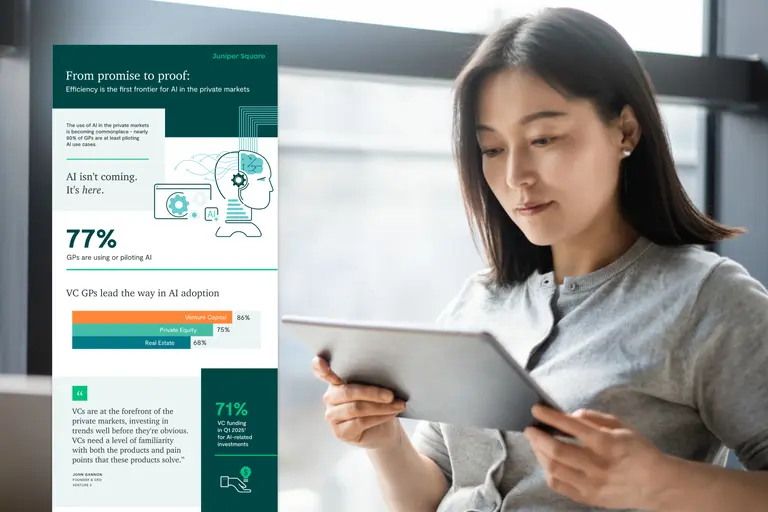

[Survey] AI in the Private Markets

Nearly 80% of GPs are moving beyond experimentation and actively deploying AI—unlocking efficiency, scale, and competitive edge.

From promise to proof: How GPs are turning AI into operational alpha

Nearly 80% of GPs are no longer just testing the waters—they’re either piloting AI in select use cases or actively deploying it across multiple departments.

Turning hotel operations into investment alpha

Carlos Rodriguez Jr., founder, president, and COO of Driftwood Capital, explains how data, technology, and an operationally driven mindset have become key differentiators in hospitality investing.

Do your firm’s internal structures help or hinder your success?

Internal structures—how decisions get made, how information flows, and what behaviors get rewarded—either create compounding competitive advantages or silently constrain growth as a firm scales.

Is your technology driving operational alpha or holding your firm back?

There's a crucial distinction between firms that just use technology to maintain the status quo and those that leverage it to create lasting competitive advantages.